Is it cheaper to buy a 32-year-old car insurance, corporate car insurance premiums, and auto insurance direct? Please compare them easily through the comparison website

Let’s all go

Hello! How do you prepare for your annual car insurance? Didn’t you re-join under the pretext of running out of time without knowing what guarantee you had before? As auto insurance is compulsory insurance, it can be legally punished if there is a gap, so it is likely that the same insurance company as last year will maintain the same product without any comparison due to time pressure.

However, in the case of 32-year-old auto insurance, insurance premiums vary depending on my driving history over the past year and the insurance company’s discount special agreement and discount rate that change every time, so I recommend you to go through premium comparison by insurance company. Do you know the limit of property compensation and interpersonal compensation 1 which are compulsory insurance among automobile insurance collateral composition? In the case of property compensation, legal obligations must be met by subscribing at least 20 million won. You can set it as much as you want from more than 20 million won, but you can currently get a guarantee of up to 1 billion won, and in the case of foreign cars, up to 2 billion won.

In the case of interpersonal compensation 1, it is subscribed to the amount prescribed by the Automobile Damage Compensation Act, and is guaranteed up to 150 million won per person in case of death or aftereffects, and 30 million won per person in case of injury. The personal compensation 1 subscription limit may not be enough to handle an accident in the event of a very large accident, so it may be made by adding voluntary insurance, personal compensation 2. Interpersonal compensation 2 guarantees damage exceeding interpersonal compensation 1, and if the collateral is subscribed to an unlimited limit, criminal punishment can be avoided by applying the Traffic Accident Handling Special Act, so if there is no special reason, it is recommended.

In the case of interpersonal compensation 1, it is subscribed to the amount prescribed by the Automobile Damage Compensation Act, and is guaranteed up to 150 million won per person in case of death or aftereffects, and 30 million won per person in case of injury. The personal compensation 1 subscription limit may not be enough to handle an accident in the event of a very large accident, so it may be made by adding voluntary insurance, personal compensation 2. Interpersonal compensation 2 guarantees damage exceeding interpersonal compensation 1, and if the collateral is subscribed to an unlimited limit, criminal punishment can be avoided by applying the Traffic Accident Handling Special Act, so if there is no special reason, it is recommended.

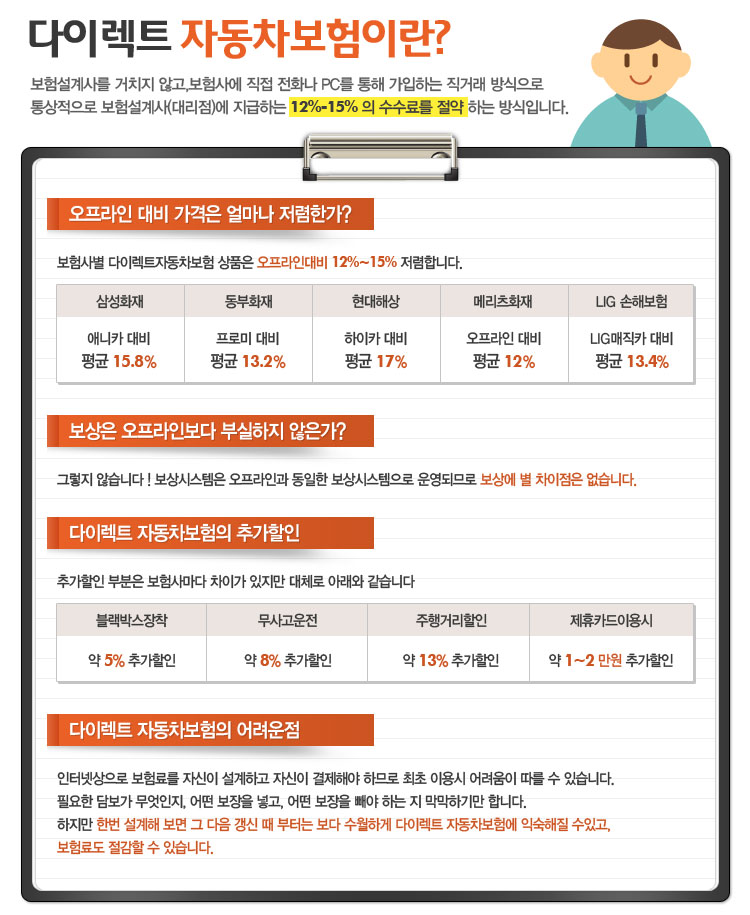

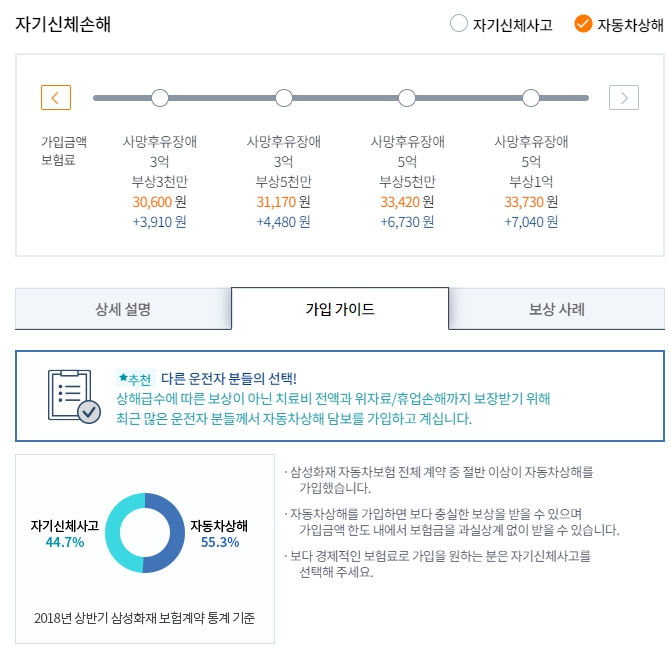

Of course, it is difficult to avoid criminal punishment when there are serious causes or consequences of accidents such as death, serious injury, escape, and 12 major gross negligence accidents. Looking at the above, do you know exactly the limit of your current mandatory auto insurance coverage? It is also a point to check the extent of my property and personal compensation, and the scope of coverage is further expanded through voluntary insurance. In addition to interpersonal compensation 2, there are several forms of voluntary automobile insurance collateral. In particular, examples include self-body accidents, car injuries, self-vehicle damages, and uninsured car injuries that can guarantee your damage, not the damage of the other party. Self-body accidents and car injury special contracts are collateral that you can choose to sign up for. In the case of self-body accidents, it is a collateral that guarantees the injury or death of the accident party or passenger due to a car accident.Automobile injuries are not related to injury water supply, but all hospital expenses are guaranteed within the prescribed limit, and damages from work and compensation may also be compensated. Car injuries have a larger coverage than self-body accidents, but there may be differences in insurance premiums, so you need to choose the right collateral for you. In the case of damage to one’s car, unlike compulsory insurance that guarantees damage to the other party in the event of an accident, it is a collateral that guarantees damage to one’s car. When insurance premiums are calculated, the amount of vehicle subscription, or vehicle purchase price, can affect and self-payment can be deducted. Finally, uninsured car injury is literally a collateral that my insurance covers my damage, which is not guaranteed if I and the other party’s vehicle where the accident occurred is an uninsured vehicle without auto insurance. If an accident occurs and the other party doesn’t have insurance, it will be a problem because there is no safety device to guarantee my damage, right? It’s a special contract that you sign up to prevent this kind of thing. In the case of 32-year-old car insurance, the terms and conditions are the same for each insurance company. However, even under the same conditions, the premium setting for each insurance company changes every time, so it is recommended to find a place where corporate vehicle insurance premiums are low at the time of subscription and compare several insurance companies. If you ask me if car insurance direct is cheaper, I will tell you that it is relatively possible.Since the conditions are the same, it is easier and more convenient to compare at a glance on the comparison site than other insurance companies, so please make sure to compare several insurers carefully on the comparison site at least once before signing up with more reasonable insurers.

Of course, it is difficult to avoid criminal punishment when there are serious causes or consequences of accidents such as death, serious injury, escape, and 12 major gross negligence accidents. Looking at the above, do you know exactly the limit of your current mandatory auto insurance coverage? It is also a point to check the extent of my property and personal compensation, and the scope of coverage is further expanded through voluntary insurance. In addition to interpersonal compensation 2, there are several forms of voluntary automobile insurance collateral. In particular, examples include self-body accidents, car injuries, self-vehicle damages, and uninsured car injuries that can guarantee your damage, not the damage of the other party. Self-body accidents and car injury special contracts are collateral that you can choose to sign up for. In the case of self-body accidents, it is a collateral that guarantees the injury or death of the accident party or passenger due to a car accident.Automobile injuries are not related to injury water supply, but all hospital expenses are guaranteed within the prescribed limit, and damages from work and compensation may also be compensated. Car injuries have a larger coverage than self-body accidents, but there may be differences in insurance premiums, so you need to choose the right collateral for you. In the case of damage to one’s car, unlike compulsory insurance that guarantees damage to the other party in the event of an accident, it is a collateral that guarantees damage to one’s car. When insurance premiums are calculated, the amount of vehicle subscription, or vehicle purchase price, can affect and self-payment can be deducted. Finally, uninsured car injury is literally a collateral that my insurance covers my damage, which is not guaranteed if I and the other party’s vehicle where the accident occurred is an uninsured vehicle without auto insurance. If an accident occurs and the other party doesn’t have insurance, it will be a problem because there is no safety device to guarantee my damage, right? It’s a special contract that you sign up to prevent this kind of thing. In the case of 32-year-old car insurance, the terms and conditions are the same for each insurance company. However, even under the same conditions, the premium setting for each insurance company changes every time, so it is recommended to find a place where corporate vehicle insurance premiums are low at the time of subscription and compare several insurance companies. If you ask me if car insurance direct is cheaper, I will tell you that it is relatively possible.Since the conditions are the same, it is easier and more convenient to compare at a glance on the comparison site than other insurance companies, so please make sure to compare several insurers carefully on the comparison site at least once before signing up with more reasonable insurers.Thanks for coming to my blog, don’t forget to follow me!Have a nice day, everyone